Look at expenses along with other costs. Besides a personal loan’s APR, Look at lenders determined by whether they cost additional costs like prepayment penalties or late payment expenses. Negative credit loans usually come with increased expenses, and these charges can add to the general expense of borrowing.

You could possibly also receive a co-signed or joint mortgage and use An additional man or woman's creditworthiness to increase your probabilities for approval. Payday loans, pawnshop loans, and automobile title loans are simple to get likewise, Nevertheless they're really costly.

Payday loan: A payday mortgage is definitely an advance on the following paycheck. These limited-phrase loans feature higher fascination prices and costs, resulting in APRs of 400% plus much more. Due to their price, they could ensure it is difficult to interrupt the cycle of financial debt.

Finally, one of the easiest forms of loans to receive with bad credit is usually a payday loan, which can be a little, limited-term loan to generally be compensated again together with your following paycheck. You should keep away from payday loans Except they're your only choice, even so, simply because they cost really high priced service fees.

Like other credit unions, APRs max at 18%, 50 percent of what lots of financial institutions together with other lenders offer you. Bank loan terms lengthen as many as eighty four months, which often can assistance preserve month to month payments cost-effective.

Here’s why: Payday loans have notoriously superior costs and quick repayment timelines — and so they don’t contribute to your credit history. With a personal bank loan from OppLoans, the corporate reviews your payments to your credit bureaus.

Get pre-capable: Submit a preliminary software with fundamental particulars to view should you qualify, which received’t have an impact on your credit In the event the lender makes use of a comfortable credit Test. The lender will tell you if you qualify and also the fees and terms you might be ready to acquire. Examine the stipulations carefully. Undergo this process with at the very least 3 lenders to help you Review delivers.

Fund disbursement: The loans on our listing produce resources immediately by means of both an Digital wire transfer to your checking account or in the form of the paper check. Some lenders (which we observed) supply the ability to spend your creditors straight.

The danger is usually that If you're able to’t fork out back the bank loan, you could lose your car. Another beneficial is usually that Common Credit offers prequalification, in order to Look at on your own eligibility without dinging your credit rating.

Editorial Note: We get paid a Fee from partner backlinks on Forbes Advisor. Commissions will not impact our editors' thoughts or evaluations. Installment loans for terrible credit help it become achievable for borrowers by using a poor or confined credit history to entry the money they have to have.

One more good thing about obtaining a bank loan by way of Upstart could be the lender’s competitive curiosity premiums. The most desire level is on the higher close—though It truly is on par for undesirable credit loans— but its bare minimum credit rating is reduced than every other lender we deemed.

You'll need a credit rating more info of a minimum of 580 to qualify for a good installment financial loan from An important lender. You will likely will need a higher rating for getting a private installment loan with no origination charge as well as a lower APR, even so.

Scores decrease than 670, and positively scores lower than 600, will most certainly disqualify you for essentially the most cost-effective own loans. But in case you are in the pinch, it isn't really all-out difficult to obtain a mortgage which has a credit rating while in the substantial 500s or lower 600s.

Particular provides that surface on This great site originate from shelling out advertisers, and this could be observed on an offer’s aspects page utilizing the designation “Sponsored”, the place applicable.

Shaun Weiss Then & Now!

Shaun Weiss Then & Now! Michael Bower Then & Now!

Michael Bower Then & Now! Melissa Joan Hart Then & Now!

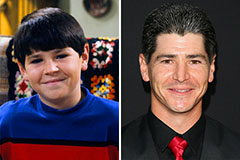

Melissa Joan Hart Then & Now! Michael Fishman Then & Now!

Michael Fishman Then & Now! Tina Majorino Then & Now!

Tina Majorino Then & Now!